Unbundled Blogs

Real Estate Education, Current Events, & Our Experiences

With more Connecticut rentals hitting the market, standing out is key. These 7 smart turnover updates help attract great tenants faster and reduce future maintenance.

Protect your CT rental investment! Learn to seamlessly set up and transfer electricity, gas, and water utilities for tenants moving in/out.

Bought your first rental? This guide for new landlords shows how to manage, grow, and succeed—with support from UPM and insights from BiggerPockets.

Discover the top 3 websites every real estate investor in Connecticut should know. From powerful national platforms to hyperlocal data sources, find out where savvy investors get their edge—and how Unbundled Property Management (UPM) helps turn online research into profitable real estate decisions.

Think self-managing a rental saves money? Think again. Discover 6 hidden costs landlords overlook—and how to protect your time, income, and peace of mind.

Renting out your home? Use this essential checklist to document everything first. Perfect for first-time or accidental landlords prepping to move out.

Accidental landlord in CT? From low rates to strong demand in towns like Glastonbury & West Hartford, here are 5 smart reasons to rent out your home.

New or out-of-state CT landlord? Security deposit laws are strict—miss a step and it could cost you. Learn key rules and how to avoid costly penalties.

Rental management is more than rent checks. From legal risks to 24/7 calls, here are 7 reasons why hiring a property manager protects your time and profit.

Zillow is a powerful tool for real estate investors, but relying on it alone can lead to costly mistakes. Learn how to spot limitations and strengthen your investment analysis.

Moved out but still own your home? You might be an accidental landlord. Here are 10 smart reasons renting it out could build wealth and boost passive income.

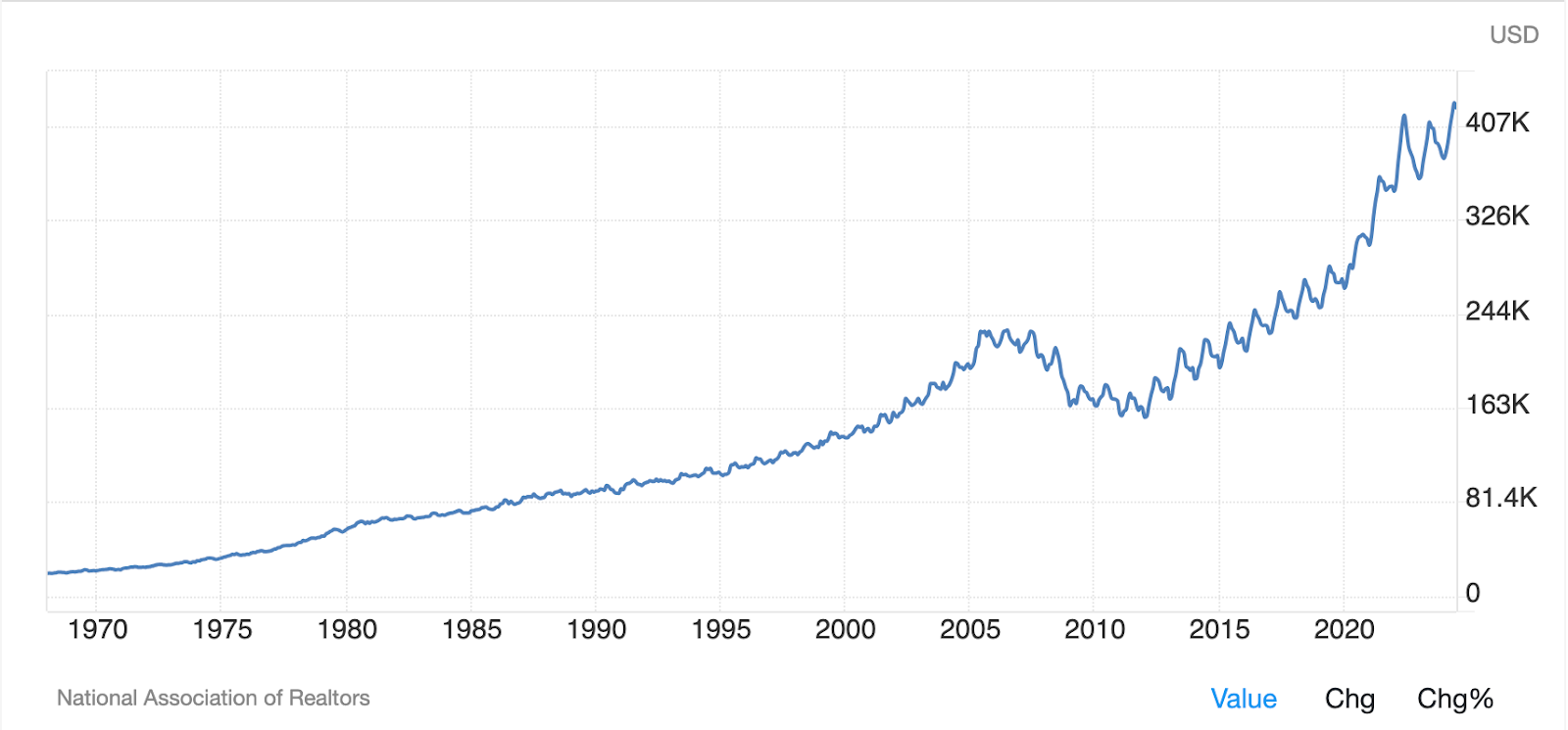

The time to invest in real estate is now. Historical data proves that property values continue appreciating over time. Below is a graph from the National Association of Realtors that reflects the median existing-home price for all housing types in the US.

BiggerPockets is a website you need to know about and explore. BiggerPockets is a comprehensive online platform that answers the needs of real estate investors through its wide array of features. With a vast array of beneficial and relevant resources, a thriving real estate community, and a focus on topics like property management, real estate investing, and rental properties, BiggerPockets is your go-to source for learning and growing in the real estate market.

When it comes to showcasing your rental property, a picture is worth a thousand words, those words can make all the difference in attracting potential tenants so, let’s dive into the art of capturing your property acquired through the lens and let us see how you can create and stunning images that will make your property stand out in the competitive CT rental market.

Finding the most optimum balance between profitability and attracting quality residents is an effective way to maximize rental income for property owners, and here’s how you do it to your own rental property.

You can significantly enhance your rental property's appeal through the help of this Ultimate Guide. These investments not only attract desirable residents but also increase the overall value of your property, ensuring a prosperous and rewarding journey as a landlord. Remember, a well-maintained and aesthetically pleasing rental property is the key to long-term success in the real estate market. Happy Investing!

Understanding the historical context of mortgage rates in the United States provides us with a broader perspective on the current situation of the real estate market. While the present rates may appear elevated, a historical lens reveals that they are closer to the norm than we might initially perceive.

1031 exchange is a powerful tool that enables investors to grow their real estate portfolio without being burdened by immediate capital gains taxes. In the current economic environment, where properties are reaching all-time highs, utilizing this tax-deferral strategy can position you for long-term success.

A well-maintained rental property is the foundation of a successful real estate investment. By following this comprehensive maintenance checklist, you can protect your investment, ensure resident satisfaction, and reduce costly repairs.

In this comprehensive guide, we will explore four popular investment options: Single Family Homes, Multi-family Homes, Condos, and Apartment Buildings. In our website’s Town and City Data, you will find more information about these real estate information for your property investment decisions. Also featured in our Town and City Data are the Housing Type Counts that consist of the popular types of property investments in Connecticut.

Connecticut's real estate market is thriving with a steady increase in average sales prices and a strong number of sales, reflecting high demand for properties. Coupled with attractive amenities, a thriving job market, and excellent schools, Connecticut offers a promising destination for real estate investments. It's a compelling landscape for real estate property buyers and sellers, presenting diverse investment opportunities in a growing real estate and property management market.

Finding off-market deals can give you a significant advantage over other buyers. These deals, not listed on popular platforms like Zillow or the Multiple Listing Service (MLS), offer an opportunity to secure properties without facing fierce competition.

When it comes to selecting the right flooring for your rental property serving Connecticut, having an informed decision can be a great selling point for the potential residents of your rental property. Whether you're a real estate investor or involved in rental management, the flooring choice can significantly impact your property's appeal and value.

Investing in real estate can be an exciting venture, but it's important to consider the potential risks involved. One significant factor that real estate investors must consider is the vacancy rate.

In Connecticut, short-term rentals (STRs), sometimes referred to as vacation rentals or Airbnb rentals, are becoming more and more well-liked since they provide convenience, affordability, and interesting experiences. There are, however, advantages and disadvantages to weigh as well as rules to follow with any rental property.

When it comes to discovering your target market as a real estate investor, the vastness of the internet can be a goldmine of information. There are several websites that can aid you in identifying specific markets you may be interested in investing in. You can always talk to your mentor to learn more about targeting your market and positioning your investment, but in this article, we'll delve into five of the most useful websites for finding your target market as a real estate investor.

One of the primary benefits of investing in condos in Connecticut is the low barrier to entry in terms of cost. Additionally, several condominiums include built-in features such as swimming pools and communal gathering places, making them appealing to tenants.

Investing in real estate? Don't skip the home inspection. A thorough assessment of the property can provide valuable information for your investment. Make sure to work with a trustworthy home inspector who is known for being thorough. Contact us at Unbundled Property Management to assess your CT property!

Onboarding new properties is one of the least predictable areas of the business, which means you better be organized and pay attention to specific details. For this blog we will focus only on the property portion of the onboarding of a new property. Of course, there are residents that come with a new property but that’s a separate procedure that we’ll discuss in a future post.

Connecticut’s first freeze is here. Learn how to protect your rental, prevent frozen pipes, and keep residents warm with simple steps before temperatures drop.